Learning about KiwiSaver and how it works

What's KiwiSaver?

KiwiSaver is a savings scheme that can help you build your savings over the long-term, for retirement. It can also help you to save for a first home.

You get to choose which investment your contributions are paid into and the size of your contributions. Even better, your employer and the government can also make contributions into your chosen investment option.

What's a contribution?

A contribution is a fancy way of describing a deposit of money into your KiwiSaver account. Contributions are invested in investment markets to earn you a rate of return, so that your money grows over time.

How do contributions work?

If you are an employee, you can choose to regularly contribute 3%, 4%, 6%, 8% or 10% from your before-tax pay. You can also make contributions if you aren't working or are self-employed.

Once you start making regular contributions to your KiwiSaver account, your employer will generally contribute 3% into your account, sometimes more. This is an addition to your contribution. The Government will also make contributions if you're eligible. With KiwiSaver, you're not on your own with growing your account balance!

Read more detailed information about contributions here.

When can you make a withdrawal from my KiwiSaver account?

You can access your KiwiSaver money:

- When you buy your first home

You can access your KiwiSaver account savings when you buy or build your first home.

- When you turn 65 years of age

You can access your money once you reach 65, however, you can continue with your KiwiSaver account investments throughout retirement.

Withdrawal criteria applies.

KiwiSaver can give you bang for your buck

How does your KiwiSaver account balance grow?

Your KiwiSaver investment can grow from these 4 main sources:

- Your contributions (pay and lump sums)

- Your employer's contributions (subject to eligibility)

- The government's contributions (subject to eligibility)

- Investment returns, compounded.

Your contribution is the first step in unlocking contributions from the government and your employer.

All contributions are then invested to generate an investment return. Compounding occurs when your investment returns get reinvested, basically, the returns created also earn a return.

Understanding more about compounding

Compounding of investment returns is a powerful way to grow your wealth. When you invest in assets that deliver a return to you (through income or capital growth), those returns get reinvested back into assets. In short, the returns you earn also earn a return, effectively making you more money.

Increasing your contributions increases the size of your capital, or total savings, which in turn increases the compounding potential.

Compounding becomes more and more powerful the longer you're invested. As a result, it pays to start the KiwiSaver investing journey as early as you can, to get the greatest compounding benefits on your investments.

Your KiwiSaver account balance can grow big-time over the long-term

Just ask Jane

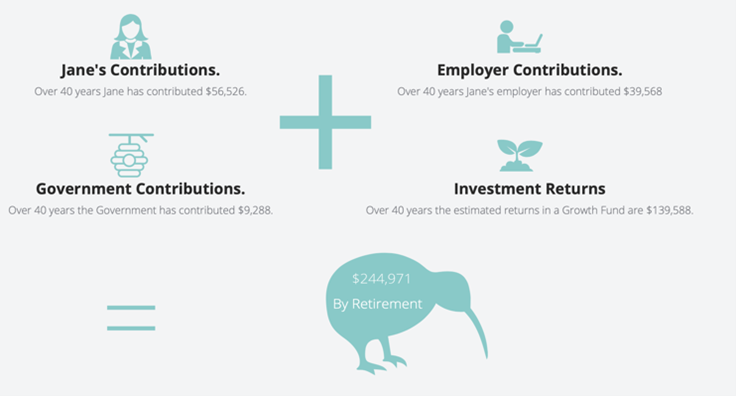

Jane is an employee. She is 25 years old and earns $50,000 p.a. She is in a Growth Fund contributing 3% per year. Jane's income is forecasted to increase by 3.5% every year. Thanks to the contributions made by herself, her employer and the government over 40 years, her account balance at the time of retirement is much higher than if she were the only contributor.

We used this simple example to show how a KiwiSaver account balance can grow over the long run. In reality, it's not a great idea to be invested in the same strategy for 40 years. In general, your investment risk should be gradually reduced as your approach retirement.

At Aurora Capital, one of our expert advisers can help you to pick a KiwiSaver option that is suitable for your age and stage of the investment journey and to understand the risks of that option. Then, because we get that life and your needs change with time, we do an annual review to make sure the option you are invested in is still right for you.

Book a meeting with an adviser

LAST UPDATED 9 JANUARY 2025

DISCLAIMER

This information is provided in a general nature only and should not be construed as or relied on as financial advice. This is not a recommendation to invest in a particular financial product or class of financial products. You should seek financial advice specific to your circumstances from a Financial Adviser before making any investment decisions.

This example above is for illustration purposes only. Actual results could vary depending on the prevailing conditions.

Past performance is not a reliable indicator of future performance. The value of your investment may go up and down.