RetirementPlus

Portfolio snapshot

With RetirementPlus, we will automatically reduce your investment risk each year from age 51 until age 80, as you move toward and into retirement. This can give you a smoother investment journey over the long-term.

Minimum suggested investment timeframe :

- Will vary with your age, see examples at ages 50, 65, 75

Risk Factor (1-7 scale):

- Will vary with your age, see examples ages 50, 65, 75

Annual fund charges:

- 1.26% - 1.50% + $36 admin fees P.A

For a detailed breakdown of fees at each RetirementPlus age step, click here.

This strategy may be suitable for Kiwis who:

Prefer...

A set-and-forget retirement savings strategy that automatically reduces risk after age 51.

Are wanting...

A seamless way to remain invested after retirement and throughout the retirement years.

Are keen to...

Help improve the health of the planet through their KiwiSaver Scheme.

Strategy composition

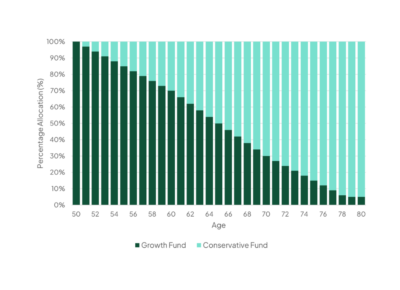

The RetirementPlus Strategy invests in a mix of two underlying funds: the Aurora Conservative Fund, and the Aurora Growth Fund. We do the work of blending them to achieve an expected risk and return that is suitable for you at each age. The chart shows that risk is reduced every year from age 51 to 80.

Portfolio characteristics at Ages 50,65,75

RetirementPlus at Age 0-50

Minimum timeframe: 10 years

80% Growth assets, 20% Income assets

Risk Factor (1-7 scale): 5

RetirementPlus at Age 65

Minimum timeframe: 6 years

52% Growth assets, 48% Income assets

Risk Factor (1-7 scale): 4

What the portfolio won't invest in

- Controversial Weapons

- Pornography production

- Tobacco production

- Nuclear Weapons Components, Systems and Support Services

- Revenue from the extraction and sale of coal

- Companies with evidence of fossil fuel reserves

For more information, please read the Aurora Statement of Investment Policy and Objectives.

Climate and environment

We monitor the climate and environment sustainability of the investments in the portfolio through relevant metrics, which can then be compared against broader market indices or 'benchmarks.' The metrics are currently provided for the equity and listed infrastructure components of the portfolio.

Data as at 31 December 2024.

RetirementPlus at Age 0-50

RetirementPlus at Age 65

RetirementPlus at Age 75

Performance and current investments

For performance and current holdings, take a look at our fact sheets

Find it here